-

-

North

-

Midlands & East

-

London

-

South West

-

Before you continue

Generic error message

The selected items have been added to your basket

View BasketYour Basket will expire in time minutes.

Appendix: The Trustees’ Investment Strategy

|

AVCs |

Additional Voluntary Contributions |

|

ESG |

Environmental, Social and Governance |

|

Investment Adviser |

The Trustees are advised on investment matters by First Actuarial LLP. First Actuarial LLP is regulated by the Institute and Faculty of Actuaries and is qualified to provide the required advice through knowledge and practical experience of financial matters relating to pension schemes. |

|

Legislation |

This statement has been drafted to comply with relevant legislation. In particular, consideration has been given to:

|

|

Scheme |

Jockey Club Racecourses Pension Scheme |

|

Trustees |

The Trustees of the Scheme |

This statement is made in accordance with the requirements of legislation. The main body of the document sets out the principles and policies that govern investments made by the Trustees whilst details of the specific investment arrangements in place are provided in the Appendix.

Throughout the statement, wording in italics represents actions that will be taken by the Trustees in the implementation and monitoring of the Scheme’s investment arrangements.

Investment advice

The Trustees received and considered written investment advice from the Investment Adviser to help with the preparation of this statement.

The Trustees will obtain and consider written advice from the Investment Adviser when reviewing the Scheme’s investment strategy or when considering the suitability of potential investments. The Trustees expect that such advice will be consistent with any guidance issued by The Pensions Regulator.

Legal advice

The Trustees will seek legal advice relating to investment matters whenever deemed necessary.

Consultation with the sponsoring employer

In preparing this statement, the Trustees consulted with the sponsoring employer.

The Trustees will consult with the sponsoring employer before making any changes to the Scheme’s investment strategy.

Conflicts of interest

The Trustees are satisfied that the Scheme’s investment strategy meets their responsibility to invest the assets in the best interests of the members and beneficiaries and, in the case of a potential conflict of interest, in the sole interest of the members and beneficiaries.

The investment beliefs stated below have been developed by the Trustees and are reflected in the Scheme’s investment strategy.

Basic investment principles

The Trustees believe that the following three basic investment principles should be taken into account in the construction of the Scheme’s investment strategy:

i) Targeting higher levels of investment return requires increased levels of investment risk which increases the volatility of the funding position.

ii) Long-term performance of the Scheme’s assets is attributable primarily to the strategic asset allocation rather than the choice of investment managers.

iii) Asset diversification helps to reduce risk.

Financially material considerations and the appropriate time horizon

The Trustees believe that the potential impact of any financially material considerations that may affect the Scheme’s investments should be assessed over the period during which benefits are expected to be paid from the Scheme. In the terminology used by legislation, the Trustees consider this period of time to be “the appropriate time horizon of the investments”.

ESG

The Trustees believe that the impact of ESG risks and opportunities can be financially material and the Trustees recognise that ESG matters, particularly climate change, should be assessed over the appropriate time horizon.

Use of active management

The Trustees believe that active management has the potential to add value either through offering the prospect of enhanced returns or through the control of volatility.

The Trustees believe that active management may help to mitigate the financial impact of ESG risks.

Stewardship

The Trustees believe that good stewardship can help create, and preserve, value for companies and markets as a whole.

Members’ views (non-financial matters)

Legislation defines non-financial matters as meaning the views of the members and beneficiaries including (but not limited to) ESG matters and the present and future quality of life of the members and beneficiaries of the Scheme.

The Trustees believe that their duty to members and beneficiaries will be best served by ensuring that all benefits can be paid as they fall due and the Trustees’ Investment Objectives are designed to ensure this duty is achieved.

In reaching this conclusion, the Trustees considered whether to take members’ views into account when determining a suitable investment strategy and in the selection, retention and realisation of investments. However, the Trustees have determined that it would not be practical to do so. In particular, the Trustees concluded that it is likely that members and beneficiaries would hold a broad range of views, which would be difficult to accommodate.

At least every three years, the Trustees will:

The Trustees’ primary investment objectives are:

The Trustees’ investment approach is designed to strike a balance between the above primary objectives but also considers:

The Trustees have taken advice from the Investment Adviser to construct a portfolio of investments consistent with these objectives. In doing so, consideration is given to all matters which are believed to be financially material.

Details of the current investment strategy are provided in the Appendix.

The Trustees will review their investment objectives and the Scheme’s strategic asset allocation at least every three years.

Types of investments to be held

The Trustees are permitted to invest across a wide range of asset classes, including, but not limited to, the following:

Use of pooled funds

Day-to-day management of the Scheme’s assets, including the selection, retention and realisation of investments, is delegated to one or more investment managers. When the Trustees require funds to meet cashflows, one or more of their investment managers will be instructed to make a disinvestment.

Taking into account the size of the Scheme’s assets, the Trustees have concluded that pooled funds represent the most pragmatic way of implementing the Scheme’s investment strategy rather than establishing segregated mandates with investment managers.

To ensure safekeeping of the assets, ownership and day-to-day control of the assets is undertaken by custodian organisations which are independent of the sponsoring employer and the investment managers. Where a pooled fund is held, the custodian will typically be appointed by the investment manager.

The assets held by the Scheme are invested predominantly on regulated markets, as so defined in legislation. Any investments that do not trade on regulated markets are kept to a prudent level.

The Trustees will primarily hold pooled funds and will ensure the Scheme’s assets are predominantly invested on regulated markets.

Use of derivatives

The Trustees may select pooled funds which are permitted to use derivative instruments to reduce risk or for efficient portfolio management. Risk reduction would include mitigating the impact of a potential fall in markets or the implementation of currency hedging whilst efficient portfolio management would include using derivatives as a cost-effective way of gaining access to a market or as a method for generating capital and/or income with an acceptable level of risk.

Leverage

Investments held to match the sensitivity of the Scheme’s liabilities to changes in interest rates and inflation may be leveraged. The use of such assets can reduce the volatility of the Scheme’s funding position.

Alignment with the Trustees’ investment principles

As the Scheme’s assets are held in pooled funds, the Trustees have limited influence over the investment managers’ investment decisions. In practice, investment managers cannot fully align their strategy and decisions to the (potentially conflicting) policies of all their pooled fund investors in relation to strategy, long-term performance of debt/equity issuers, engagement and portfolio turnover.

It is therefore the Trustees’ responsibility to ensure that the approaches adopted by investment managers are consistent with the Trustees’ policies before any new appointment, and to monitor and to consider terminating any existing arrangements that appear to be investing contrary to those policies.

The investment managers are incentivised to maintain an approach consistent with that when they were appointed by the Trustees by the payment of the investment management fee (and in the knowledge that a change of approach may cause investors to reconsider the investment).

The Trustees expect investment managers, where appropriate, to make decisions based on assessments of the longer term financial and non-financial performance of debt/equity issuers, and to engage with issuers to improve their performance. The Trustees assess this when selecting and monitoring managers.

Duration of Investment Manager Arrangements

Although the Trustees review the ongoing suitability of the pooled funds held regularly, the expectation is that pooled funds will normally be held for several years.

AVCs

AVCs are held separately from the Scheme’s other investments and the AVCs are used to secure benefits on a money purchase basis for members at retirement. From time to time the Trustees review the ongoing suitability of the AVC arrangements.

Details of the current AVC arrangements are provided in the Appendix.

In assessing the suitability of a pooled fund, the Trustees consider, in conjunction with the Investment Adviser, how the fund would fit within the Scheme’s investment strategy and how the fund is expected to help the Trustees meet their investment objectives. As part of this consideration, all matters which are deemed to be financially material are taken into account including:

*This includes engaging with an issuer of debt or equity regarding matters including (but not limited to) performance, strategy, capital structure, management of actual or potential conflicts of interest, risks, and ESG considerations. It also includes engaging on these matters with other investment managers, other holders of debt or equity and persons or groups of persons who have an interest in the issuer of debt or equity.

At least every three years, the Trustees will review whether the ongoing use of each fund remains consistent with their investment strategy.

The Trustees will ensure any new pooled funds introduced into the investment strategy are appropriate to the circumstances of the Scheme.

The Trustees review the Scheme’s investments for all matters considered to be financially material (including ESG matters) regularly. This includes reviewing that each fund continues to operate in a manner that is consistent with the factors used by the Trustees to select the fund and that the choice of funds remains appropriate.

When assessing the performance of a fund, the Trustees do not usually place too much emphasis on short-term performance although they will seek to ensure that reasons for short-term performance (whether favourable or unfavourable) are understood.

To assist with the monitoring of the investment managers, the Trustees receive regular information from the Investment Adviser providing details of investment manager performance and asset allocation decisions. This analysis includes comparisons with benchmarks and relevant peer-group data. The analysis also assesses whether performance has been in line with expectations given market conditions and whether the level of risk has been as expected.

The Investment Adviser also provides regular updates on the investment managers’ actions regarding ESG matters and shareholder engagement.

The Investment Adviser regularly meets with the managers of pooled funds on its approved list.

In monitoring portfolio turnover costs for a pooled fund, the Trustees expect investment managers to provide cost data under the framework developed by the Cost Transparency Initiative.

Action when a pooled fund is causing concern

Where concerns about a fund are identified, the Trustees may look to reduce exposure to that fund or disinvest from it entirely. However, such action is expected to be infrequent, and, in the first instance, the Trustees would normally expect the Investment Adviser to raise the concerns with the investment manager. Thereafter, the Trustees, in conjunction with the Investment Adviser, would monitor the position to assess whether the situation improves.

The Trustees will regularly assess the ongoing suitability of each pooled fund held for all matters deemed to be financially material (including ESG matters and portfolio turnover costs).

The Trustees’ policy in relation to the exercise of rights attaching to investments and undertaking engagement activities in respect of investments is that they wish to encourage best practice in terms of stewardship.

However, because the Scheme’s assets are invested in pooled funds, the Trustees accept that ongoing engagement with the underlying companies (including the exercise of voting rights) will be determined by the investment managers’ own policies on such matters. The Trustees consider policies on engagement and voting in making decisions about retaining and appointing investment managers.

As a result of the use of pooled funds, the Trustees recognise that their ability to directly influence the action of companies is limited. Where the Trustees are unhappy with a manager’s engagement and / or voting, then in the first instance they would discuss this with the manager. Should this not resolve the Trustees’ concerns, then ultimately the Trustees may choose to disinvest.

The Trustees recognise that members might wish the Trustees to engage with the underlying companies in which the Scheme invests with the objective of improving corporate behaviour to benefit the environment and society. However, the Trustees’ priority is to select investment managers which are best suited to help meet the Trustees’ investment objectives, and ultimately to ensure that members’ benefits can be paid as and when they fall due. In making this assessment, the Trustees will receive advice from the Investment Adviser.

The Trustees recognise that investment managers’ engagement policies are likely to be focussed on environmental or societal benefits largely to the extent that these are consistent with maximising financial returns and minimising financial risks.

Nevertheless, the Trustees expect that each investment manager should discharge its responsibilities in respect of investee companies in accordance with that investment manager’s own corporate governance policies and current best practice, such as the UK Stewardship Code and the UN Principles for Responsible Investment.

The Trustees expect that, where appropriate, each investment manager should take ESG considerations into account when exercising the rights attaching to investments and in taking decisions relating to the selection, retention and realisation of investments.

The Trustees expect that the investment managers selected to manage the Scheme’s assets should invest for the medium to long term and should engage with issuers of debt or equity with a view to improving performance over this time frame.

The Trustees will review the stewardship policies of the investment managers on an annual basis.

The principal investment risks identified by the Trustees are listed below together with an explanation of how they are mitigated.

Indirect credit risk

The risk that an investment held within a pooled fund will suffer a financial loss because of a third party failing to pay monies that it owes.

Currency risk

The risk that the value of an investment will fall because of adverse movements in currency markets.

Real return risk

The risk that the Scheme’s assets do not deliver a long-term return in excess of inflation.

ESG risk

The risk that ESG factors will adversely impact the value of the Scheme’s investments.

Investment manager risk

The risk that an investment manager does not deliver returns in line with expectations.

Mitigation of the above risks

The risks listed above are mitigated by the Trustees monitoring the suitability of the pooled funds used by the Scheme. This monitoring is carried out in conjunction with the Investment Adviser.

Solvency and employer covenant risk

The risk that the Scheme’s assets fall short of the amount required to pay all benefits and expenses as they fall due and that insufficient assets could be recoverable from the sponsoring employer to meet the shortfall.

Mitigation

The Trustees’ funding approach is designed to be prudent and, in determining the funding and investment strategy, the Trustees consider the strength of the covenant of the sponsoring employer.

Self-Investment risk

The risk that the Scheme’s assets are linked to the sponsoring employer which could mean a reduction in the covenant of the sponsoring employer would simultaneously decrease the value of the Scheme’s assets.

Mitigation

The Trustees will ensure exposure to employer-related assets does not exceed limits prescribed in legislation.

Direct credit risk

The risk that disruption with an investment manager (such as fraud or insolvency) could adversely impact the value of the Scheme’s investments.

Mitigation

Any pooled funds held are structured such that the Scheme’s assets are ringfenced from the assets of the investment manager and other investors.

There are a number of mitigants in relation to fraud, including the investment managers’ internal controls.

Interest rate risk and inflation risk

The risk that movements in interest rates/expectations for future inflation will adversely impact the value of the Scheme’s investments.

Mitigation

Any assets held which have significant interest rate/inflation exposure will be selected to offset the sensitivity of the Scheme’s liabilities to interest rate/inflation movements. This approach mitigates interest rate risk and inflation risk.

Market Risk

The risk that the Scheme’s assets do not deliver a sufficient return, because of falls in investment markets.

Mitigation

The Trustees have an investment approach which is diversified across different asset classes.

Liquidity Risk

The risk that assets cannot be realised for cash when required.

Mitigation

The Trustees will invest the majority of the Scheme’s investments in funds which can be realised for cash at relatively short notice without incurring high costs. However, the Trustees recognise that the Scheme’s liabilities are long-term in nature and that a modest allocation to less-liquid investments may be appropriate.

Operational Risk in relation to LDI

The risk that sufficient cash cannot be passed across sufficiently quickly to recapitalise the Scheme’s LDI investments.

Mitigation

The Trustees have an automatic rebalancing arrangement in place and the platform provider is instructed to pass across the required cash automatically without the need for further Trustee intervention. The Trustees monitor the amount in the funds that are used in the automatic rebalancing arrangement.

The Trustees will:

The Trustees will review this statement at least every three years and without delay after any significant change in circumstances or investment strategy.

The Trustees will consult with the sponsoring employer before amending this statement.

The Trustees will obtain and consider written advice from the Investment Adviser before amending this statement.

The principles set out in this Statement have been agreed by the Trustees:

Signed:…William Medlicott ………………………………………………… Date: 6 May 2024 ………………………

For and on behalf of the Trustees of the Jockey Club Racecourses Pension Scheme.

Appendix: The Trustees’ Investment Strategy

Strategic Asset Allocation

In determining the strategic asset allocation, the Trustees view the investments as falling into two broad categories:

1. Growth Assets – Assets that are expected to deliver long-term returns in excess of liability growth. The use of Growth Assets is expected to deliver a level of investment returns deemed appropriate by the Trustees given the risk involved.

2. Liability Matching Assets – Assets that are expected to react to changes in market conditions in a similar way to the liabilities. The use of Liability Matching Assets is expected to protect the funding position of the Scheme.

At the time of agreeing the investment strategy, the strategic split of the Scheme’s assets between Growth and Liability Matching Assets was 62% Growth and 38% Liability Matching. This split is not regularly rebalanced and will fluctuate over time as market conditions change.

The strategic allocation for the Growth Assets is as follows:

|

Asset Class |

Current (as % of growth assets) |

Current (as % of total assets) |

|

Alternatives |

14.6% |

9.0% |

|

Equities |

29.4% |

18.1% |

|

Diversified Growth Funds |

5.5% |

3.4% |

|

Diversified Credit Funds |

50.5% |

31.1% |

|

Total Growth Assets |

100% |

61.6% |

Note that the allocation to Diversified Credit Funds is being built up as the proceeds of the previously held Property Fund become available.

The strategic allocation for the Liability Matching Assets is as follows:

|

Asset Class |

Current (as % of matching assets) |

Current (as % of total assets) |

|

LDI |

92.4% |

35.5% |

|

Corporate Bonds |

7.6% |

2.9% |

|

Total Liability Matching Assets |

100% |

38.4% |

The Liability Matching Portfolio is currently designed to match approximately 83% of the sensitivity of the Statutory Funding Objective liabilities to changes in gilt yields and inflation, but this may be reviewed in light of changes to market conditions and/or the Scheme's funding level.

In addition, the Trustees may hold cash in the Trustees’ bank account – particularly if it is to be used to make payments due in the short-term.

The allocation of the Growth Assets is not automatically rebalanced but will be monitored and rebalanced at the discretion of the Trustees. The strategic split by fund is in the Scheme’s Investment Implementation Policy.

Additional Voluntary Contributions

The Scheme’s AVC arrangements are held with Royal London, Utmost Life and Pensions (Utmost).

The Jockey Club Racecourses Pension Scheme (“the Scheme”)

Chair’s Statement – 31 July 2023

In accordance with the requirements of the Occupational Pension Schemes (Charges and Governance) Regulations 2015 (‘the Regulations’), the Trustees are required to provide a statement relating to the governance of the defined contribution benefits within the Scheme.

This statement covers the period from 1 August 2022 to 31 July 2023 and has been prepared by the Chair of the Trustees – William Medlicott.

In this scheme there are two different sets of DC members; those with Protected Rights and those who are AVC members.

For Protected Rights Account members, the following sections will cover Governance, Charges and Net Investment returns.

For AVC only members, please refer to the sections that follow the Protected Rights Account members information.

Background

The Scheme is a defined benefit (DB) arrangement which means that the benefits are calculated on a pre-determined basis specified in the Scheme Rules. The Scheme was contracted out using the protected rights method in respect of service accrued after 6 April 1997 (providing each member with a protected rights account). These protected rights accounts act as an underpin to the defined benefits payable under the Scheme Rules.

Upon retirement, death or transferring out of the Scheme, the value of the defined benefit is checked against the value of the protected rights account and the higher benefit is provided to the member.

The assets in relation to these protected rights benefits are invested within the DB assets of the Scheme. Members therefore have a notional protected rights account, which is valued in line with the return on the Scheme’s DB assets.

Where members had less than two years’ service and left the Scheme prior to 6 April 2012, their protected rights accounts were retained within the Scheme and form a defined contribution (DC) only benefit as at that time, it was not possible to provide a return of contributions in respect of their protected rights contributions.

Following the abolition of protected rights on 6 April 2012, the Trustees made a resolution in June 2012 which converted members’ protected rights funds into individual accumulation funds which act in the same way as non-protected rights funds but continued to act as an underpin to post 97 benefits.

The Trustees are currently in the process of discharging these benefits with a small number of members trying to be traced to complete the exercise.

In addition to those members with protected rights accounts, all members could make additional voluntary contributions (AVCs) on a DC basis to provide additional benefits at retirement.

Governance of the Default Investment Arrangement

Protected Rights Account

The assets in relation to the protected rights benefits are invested within the Scheme’s DB assets. As such, this is the Scheme’s default investment arrangement for DC benefits, as defined in the Regulations.

In the Scheme there are members with Protected Rights only and others who have Protected Rights with DB benefits as well.

As part of the actuarial valuation as of 31 July 2023, using best estimate valuation calculations, the total Protected Rights underpin amount was £900,000 consisting of £55,000 in respect of Protected Right only members and £845,000 for those with a Protected Rights underpin with DB benefits.

The Trustees do not formally review the investment strategy of the assets attributed to the DC protected rights accounts to assess its appropriateness for members but regularly review the investment strategy and performance of the assets in relation to the DB funding. The last formal review of the investment strategy for the Scheme’s DB assets was in April 2021 with further consideration given more recently resulting in a series of adjustments made to the strategy.

Charges and Transaction Costs

Protected Rights Account

The investment returns on the Scheme’s DB assets considers the annual fund management charges of between 0.14% to 1.50% depending on the investment fund. However, members with Protected Rights benefits have notional holdings in the DB scheme and for the purposes of the valuation of these benefits, assumed investment growth is linked to the FTSE All Share Total Return index and an allowance for investment expenses of 0.50% pa is made.

These charges are incurred by members when valuing their protected rights accounts to assess whether the underpin bites. Given this basis of valuation, a projection of the effect of charges and costs has not been included as a result.

Net Investment Returns for the DC Section

Protected Rights Account

The following table reflects the actual performance of the DB Scheme over varying periods which the DC Section’s returns are based on.

These returns have been manually calculated using growth asset only returns taken from the report and accounts over the last 3 years ending 31 July 2023.

|

Fund % pa |

1 year |

3 years |

|

Protected Rights Account |

-0.05% |

7.50% |

The Trustees have prepared a Statement of Investment Principles which sets out the Trustees’ aims and objectives relating to {the Defined Benefit/} investment strategy. A copy of the SIP can be found https://www.thejockeyclub.co.uk/defined-benefit-pension-scheme/

Governance of the Default Investment Arrangement

AVC only

There is no default investment fund requirement for AVC members, with a range of funds available for investment.

As of 31 July 2023, the AVC funds under management were:

|

Fund |

Funds under Management |

|

Utmost Life and Pensions |

£67,443 |

|

Royal London |

£297,872 |

|

Total |

£365,315 |

The Scheme currently offers a range of AVC investment choices with both Utmost Life and Pensions (Utmost, formerly Equitable Life) and Royal London. The Scheme deemed default investment arrangement for the AVCs, as defined in the Regulations, is the Cautious Lifestyle Strategy (Annuity) with Royal London, under which funds are invested more cautiously as members near retirement age, with the aim of buying an annuity at retirement. The default investment option changed from the Cautious Retirement Investment Strategy in 2021, as part of a review which Royal London conducted on its legacy strategies.

The underlying funds which make up the Cautious Lifestyle Strategy (Annuity) and the de-risking period is detailed in the table below:

|

Fund |

Time Period |

|

Royal London Governed Portfolio 1 |

15 years or more from retirement |

|

Royal London Governed Portfolio 2 (Annuity) |

10 years from retirement |

|

Royal London Governed Portfolio 3 (Annuity) |

5 years from retirement |

|

Royal London Annuity |

At Retirement |

On 1 January 2020, Equitable Life transferred all its policies to Utmost, and members who were invested in the With Profits fund had their fund holdings switched to Unit Linked funds from this date. Monies previously held in the Secure Cash fund for the first 6 months moved into the Investing at Age range of funds with effect from 1 July 2020.

As part of the transition from Equitable Life to Utmost, the Trustees communicated details to members about the default lifestyle fund options with Utmost, recommending that members consider whether the way in which their AVCs are invested remains appropriate.

The Trustees considered the appropriateness of the current AVC arrangements in June 2023, as well as the options available to them. This review was undertaken in the knowledge that most members use their AVC funds as the first option to provide additional tax-free cash at retirement. The Trustees concluded that no changes needed to be made at this time, however they Trustees plan to communicate to members about the options available to them in relation to the AVC arrangements.

Charges and Transaction Costs

AVCs only

In addition to the default option, members are able to self-select their AVC investment funds. The total expense ratio (TER) for each fund, which is made up of an annual management charge and other indirect costs for the Royal London funds is 0.53% pa.

All AVC funds under management with Utmost have been invested in Unit Linked funds since 1 January 2020. These funds are subject to an ongoing investment management charge between 0.53% - 0.75% per annum. The TER charge for the Clerical Medical With-Profits fund is considered when declaring annual interest rates rather than being an explicit charge deducted from members’ funds.

In addition to these explicit member charges, members may also incur transaction costs (incurred as a result of buying, selling, lending or borrowing investments). The transaction costs for the Royal London funds are calculated to 31 July 2023 and the Utmost/Clerical Medical funds are to 30 June 2023.

The following tables summarise the total costs and charges for the funds invested in, as follows:

ROYAL LONDON FUNDS

|

Fund |

Total Expense Ratio (TER) |

Transaction costs (%) |

Total costs to members |

|

Royal London Cautious Retirement Investment Strategy (default) |

|||

|

Royal London Governed Portfolio 1 |

0.53% |

0.05% |

0.58% |

|

Royal London Governed Portfolio 2 (Annuity) |

0.53% |

0.01% |

0.54% |

|

Royal London Governed Portfolio 3 (Annuity) |

0.53% |

0.00% |

0.53% |

|

Royal London Annuity |

0.53% |

0.00% |

0.53% |

|

Self-select funds |

|||

|

Royal London Deposit |

0.53% |

0.05% |

0.58% |

|

Royal London European |

0.53% |

0.00% |

0.53% |

|

Royal London Fixed Interest |

0.53% |

0.03% |

0.56% |

|

Royal London Managed |

0.53% |

0.06% |

0.59% |

|

Royal London Property |

0.53% |

0.07% |

0.60% |

|

Royal London BlackRock ACS Global Equity Index (60:40) |

0.53% |

0.00% |

0.53% |

|

Royal London Blackrock Consensus |

0.53% |

0.09% |

0.62% |

|

Royal London With Profits |

0.53% |

0.12%* |

0.65% |

Utmost Funds

|

Fund |

Total Expense Ratio (TER) |

Transaction costs (%) |

Total costs to members |

|

Self-select funds |

|||

|

Utmost Investing at Age ** |

0.75% |

0.24% -0.29% |

0.99% - 1.04% |

|

Utmost Multi Asset Moderate |

0.75% |

0.24% |

0.99% |

|

Utmost Multi Asset Cautious |

0.75% |

0.29% |

1.04% |

|

Utmost Money Market (Deposit) |

0.50% |

0.01% |

0.51% |

|

Utmost Managed |

0.75% |

0.20% |

0.95% |

|

Utmost UK Equity |

0.75% |

0.28% |

1.03% |

|

Clerical Medical With-Profits*** |

0.50% |

0.39% |

0.89% |

* Transaction charge is to 31 December 2021.

** Members of Equitable Life’s With-Profits Fund were transferred into Utmost’s Secure Cash Fund on 1 January and remained there until 30 June 2020. Where no election was made to transfer to another fund during this period, members’ investments were placed into the Investing at Age target dated funds. Due to the nature of the funds the asset mix and TER will depend on the term to retirement for each member.

***The total expense ratio is implicit in the bonus rate set for the current year.

The Utmost Investing at Age strategy uses an Automatic Investment Option which means it is designed to gradually reduce a member’s exposure to equities from age 55 to and through taking their retirement benefits. The strategy uses a combination of the Utmost Multi Asset Moderate and Cautious funds to achieve this balance.

For the Clerical Medical With-Profits Fund, members are also eligible to receive a final bonus at maturity. The amount of the final bonus may be lower, or nil, on transfer or encashment before maturity.

A Market Value Reduction may be applied to the With Profits Fund on transfer or encashment before maturity. This ensures that members who choose to leave the fund before their normal retirement date do so on terms that properly reflect the underlying value of their policy.

In addition to the above member-borne costs and charges, the sponsoring employer meets the cost of ongoing governance and administration services for the AVC’s.

In assessing value-for-members for the AVC scheme, the Trustees have only considered the costs and charges met by members.

The Appendix to this Statement provides an illustration of the cumulative effect of charges for the AVC scheme only and not the DC protected rights given the way members benefits are notionally attributed.

Net Investment Returns

AVCs only

The following table reflects the performance of each fund over varying periods based on investment after charges have been deducted and has taken into account the statutory guidance when preparing this section of the statement. They have been calculated on a geometric basis and assume a £10,000 investment fund.

Royal London Funds

|

Fund |

1 year |

3 years |

5 years |

10 years |

15 years |

20 years |

|

Royal London Cautious Lifestyle Strategy (default) |

||||||

|

Royal London Governed Portfolio 1 |

-0.34% |

5.92% |

3.80% |

6.34% |

7.01% |

n/a |

|

Royal London Governed Portfolio 2 (Annuity) |

-1.87% |

3.56% |

2.93% |

5.50% |

n/a |

n/a |

|

Royal London Governed Portfolio 3 (Annuity) |

-5.18% |

-1.04% |

1.08% |

3.41% |

n/a |

n/a |

|

Royal London Annuity |

-5.77% |

-3.92% |

-0.29% |

n/a |

n/a |

n/a |

|

Self-select funds |

||||||

|

Royal London Deposit |

3.38% |

1.15% |

0.90% |

0.59% |

0.73% |

1.75% |

|

Royal London European |

16.97% |

10.47% |

6.86% |

8.23% |

8.05% |

9.11% |

|

Royal London Fixed Interest |

-13.20% |

-10.15% |

-3.07% |

0.76% |

2.63% |

2.77% |

|

Royal London Managed |

0.88% |

6.92% |

4.13% |

6.32% |

6.88% |

7.03% |

|

Royal London Property |

-14.09% |

2.44% |

1.42% |

5.43% |

4.03% |

4.55% |

|

Royal London BlackRock ACS Global Equity Index (60:40) |

7.60% |

11.44% |

5.03% |

7.23% |

7.79% |

8.20% |

|

Royal London Blackrock Consensus |

4.41% |

6.50% |

4.36% |

6.30% |

6.88% |

7.38% |

|

Royal London With Profits* |

n/a |

n/a |

n/a |

n/a |

n/a |

n/a |

*Royal London With Profit fund have not provided past performance information. Annual bonuses are added, and a final bonus may be payable. In 2022, an annual bonus of 2.15% was added (including profit share).

Utmost Funds

|

Fund |

Launch date |

1 year |

3 years |

5 years |

Since launch |

|

Self-select funds |

|||||

|

Utmost Multi Asset Moderate |

1 January 2020 |

1.16% |

4.45% |

n/a |

0.79% |

|

Utmost Multi Asset Cautious |

1 January 2020 |

-3.65% |

-1.19% |

n/a |

-1.79% |

|

Utmost Money Market (Deposit) |

3 December 1984 |

3.01% |

0.81% |

0.59% |

4.39% |

|

Utmost Managed |

3 December 1984 |

2.98% |

6.72% |

2.72% |

7.75% |

|

Utmost UK Equity |

3 December 1984 |

5.04% |

10.96% |

1.99% |

8.07% |

|

Clerical Medical With-Profits* |

- |

n/a |

n/a |

n/a |

n/a |

We have been unable to obtain net investment returns for the Clerical Medical With-Profits Fund. The Utmost performance has been produced to 29 July 2022.

Value for Members

Under the Occupational Pension Schemes (Administration, Investment, Charges and Governance) (Amendment) Regulations 2021, trustees of schemes providing DC benefits are required to carry out an assessment of their scheme’s value for members from their first scheme year-end after 31 December 2021.

Following the Regulator’s guidance, an assessment of value for members has been carried out for the Protected Rights accounts which considered the following aspects:

Looking at the costs and charges, the DC benefits of the Scheme are more expensive than those quoted by another comparator DC pension provider who also include administration services within their AMC.

It should however be noted that whilst they have provided indicative terms, they are unable to accept benefits from the scheme given the underpins that exist.

Looking at net investment returns, again using the performance of the DB Scheme as a proxy in the absence of insured pooled funds for DC members. There is no default or range of self-select funds for members to choose, so attributed performance is based entirely on the growth assets of the DB Scheme.

Performance over 3 years shows solid positive returns. When reviewed against the other comparator schemes used in the assessment, the DC Section did not deliver broadly equivalent returns over the time periods considered.

There are some other areas where improvements could be made when considering Governance and Administration.

These relate to:

While falling outside the scope of the value for member assessment regulations outlined by the Pensions Regulator, we note that members have AVCs with Royal London and Utmost which appear to be satisfactory given the review that has taken place.

Overall, our assessment concludes that the DC benefits do not meet the requirements laid down by The Pensions Regulator.

There are certain changes that can be made that are simple and practical to implement which we have noted above.

We are mindful that the Regulator expects member outcomes to be improved where their standards are not met. We have taken a number of steps to explore alternative remedies. The reality is that for a small value of funds, where no new monies are being added providers are unable or unwilling to offer suitable alternative and better arrangements. We will continue to review and seek to improve the current arrangements as far as is possible.

The Trustees will consider the assessment in further detail and the recommendations contained in it with a view to implementing change where needed.

Core Financial Transactions

The Trustees receive and review reports from the Scheme’s administrators on at least a 6-monthly basis to monitor the level of administration services being provided to members.

The processing of core financial transactions is monitored by the administrators, who have implemented internal control procedures to help ensure that such transactions are processed promptly and accurately (including a relevant review process). These activities include procedures to ensure the accuracy of benefit calculations and settlements and the prompt resolution of any inconsistencies identified. Activities covered include controls and procedures to manage the settlement of benefits and individual transfers out.

The Trustees are satisfied that during the period of this statement, there have been no significant delays in processing these transactions or issues to report. The latest administration report showed that 100% of service levels were met.

Trustee Knowledge & Understanding

It is important that the Trustees continue to have sufficient knowledge and understanding to fulfil their duties. This is complemented by having a professional trustee (Capital Cranfield Trustees) on the trustee board. All new Trustees are required to undertake training following their appointment, including use of the Pensions Regulator’s Trustee Toolkit.

All Trustees have also been provided with and have a working knowledge of the Scheme’s documents including the Trust Deed and Rules, SIP and other informal policies.

The Trustees are supported by independent and professional advisers who ensure that they are kept abreast of the latest legislative, regulatory and market developments that apply to the Scheme. These advisory appointments are also periodically reviewed.

Training is delivered during Trustees’ meetings when the Trustees are considering issues, the understanding of which is enhanced through training. Relevant training materials are included in Trustees’ meeting packs.

All training received by the Trustees is recorded and the training needs of the Trustees are regularly reviewed by the Trustees and their advisers to identify any relevant gaps in knowledge.

The annual DC value for member assessment is an agenda item at the Trustees’ meeting.

In addition, Capital Cranfield Trustees are subject to AAF audit requirements which require each of its professional trustees to attend a number of technical training sessions per year.

Member Communications

Annual statutory money purchase illustrations were provided to members in respect of their AVC funds. No other DC communications were provided.

How to contact the Trustees

If you have any further queries regarding the Scheme, please contact:

First Actuarial LLP

2nd Floor

Mayesbrook House

Lawnswood Business Park

Leeds

LS16 6QY

Tel: 0113 818 7300

Email: leeds.admin@firstactuarial.co.uk

|

|

William Medlicott

Chair of the Trustees of the Jockey Club Racecourses Pension Scheme

[Date]

Appendix – Cumulative impact of costs and charges (AVC scheme only)

The tables below show the cumulative impact of costs and charges (as set out in the main body of this Statement) for the AVC scheme only.

They are presented in the format prescribed by legislation and on the specific assumptions outlined below. In considering choices, members should have regard to the impact of inflation and charges but also the actual investment performance of their fund choices.

The following table assumes a lump sum of £12,597 with assumed future growth rates by asset type as set out in the footnote, and then discounted for assumed inflation at 2.5% pa. This then shows the projected pots in “today’s money”.

Royal London – Default Funds

|

Projected Pension Pot in today’s money |

|||||||||

|

Royal London Governed Portfolio 1 |

Royal London Governed Portfolio 2 (Annuity) |

Royal London Governed Portfolio 3 (Annuity) |

Royal London Annuity |

||||||

|

Years |

Before charges |

After all costs and charges |

Before charges |

After all costs and charges |

Before charges |

After all costs and charges |

Before charges |

After all costs and charges |

|

|

1 |

£13,049 |

£12,976 |

£13,015 |

£12,947 |

£12,932 |

£12,865 |

£12,827 |

£12,760 |

|

|

3 |

£14,002 |

£13,768 |

£13,894 |

£13,677 |

£13,628 |

£13,418 |

£13,299 |

£13,092 |

|

|

5 |

£15,025 |

£14,609 |

£14,831 |

£14,448 |

£14,361 |

£13,994 |

£13,788 |

£13,433 |

|

|

10 |

£17,920 |

£16,942 |

£17,462 |

£16,571 |

£16,373 |

£15,547 |

£15,092 |

£14,325 |

|

|

15 |

£21,373 |

£19,647 |

£20,560 |

£19,005 |

£18,666 |

£17,272 |

£16,519 |

£15,275 |

|

|

20 |

£25,492 |

£22,785 |

£24,206 |

£21,798 |

£21,281 |

£19,188 |

£18,081 |

£16,289 |

|

|

25 |

£30,405 |

£26,423 |

£28,500 |

£25,001 |

£24,262 |

£21,317 |

£19,791 |

£17,370 |

|

|

30 |

£36,265 |

£30,643 |

£33,555 |

£28,674 |

£27,660 |

£23,681 |

£21,662 |

£18,523 |

|

|

35 |

£43,253 |

£35,536 |

£39,507 |

£32,887 |

£31,534 |

£26,309 |

£23,711 |

£19,753 |

|

|

40 |

£51,589 |

£41,211 |

£46,515 |

£37,719 |

£35,951 |

£29,227 |

£25,953 |

£21,063 |

|

Other funds available to AVC Members

|

Projected Pension Pot in today’s money |

||||

|

|

Utmost Multi Asset Cautious (Highest charges) |

Royal London European (Lowest charges) |

||

|

Years |

Before charges |

After all costs and charges |

Before charges |

After all costs and charges |

|

1 |

£12,962 |

£12,831 |

£13,126 |

£13,059 |

|

3 |

£13,725 |

£13,313 |

£14,252 |

£14,035 |

|

5 |

£14,532 |

£13,812 |

£15,474 |

£15,085 |

|

10 |

£16,764 |

£15,145 |

£19,008 |

£18,063 |

|

15 |

£19,339 |

£16,606 |

£23,350 |

£21,630 |

|

20 |

£22,309 |

£18,207 |

£28,683 |

£25,902 |

|

25 |

£25,736 |

£19,964 |

£35,234 |

£31,017 |

|

30 |

£29,689 |

£21,890 |

£43,281 |

£37,142 |

|

35 |

£34,249 |

£24,001 |

£53,166 |

£44,476 |

|

40 |

£39,509 |

£26,316 |

£65,309 |

£53,259 |

Assumptions:

Governed Portfolio 1 3.59% pa above inflation

Governed Portfolio 2 (Annuity) 3.32% pa above inflation

Governed Portfolio 3 (Annuity) 2.66% pa above inflation

Royal London Annuity 1.82% pa above inflation

Utmost Multi Asset Cautious 2.90% pa above inflation

Royal London European 4.20% pa above inflation

Jockey Club Racecourses Pension Scheme

Implementation Statement

Year Ending 31 July 2023

Glossary

|

ESG |

Environmental, Social and Governance |

|

Investment Adviser |

First Actuarial LLP |

|

BlackRock |

BlackRock Investment Management (UK) Limited |

|

Partners |

Partners Group AG |

|

Scheme |

Jockey Club Racecourses Pension Scheme |

|

Scheme Year |

1 August 2022 to 31 July 2023 |

|

SIP |

Statement of Investment Principles |

|

UNPRI |

United Nations Principles for Responsible Investment |

Introduction

This Implementation Statement reports on the extent to which, over the Scheme Year, the Trustees have followed their policy relating to the exercise of rights (including voting rights) attaching to the Scheme’s investments. In addition, the Implementation Statement summarises the voting behaviour of the Scheme’s investment managers and includes details of the most significant votes cast and the use of the services of proxy voting advisers.

In preparing this statement, the Trustees have considered guidance from the Department for Work & Pensions which was updated on 17 June 2022.

Relevant Investments

The Scheme’s assets are invested in pooled funds and some of those funds include an allocation to equities. Where equities are held, the investment manager has the entitlement to vote.

At the end of the Scheme Year, the Scheme invested in the following funds which included an allocation to equities:

The Partners Fund (Guernsey) typically has an allocation of only 20% to equities and accounted for only 9% of the Scheme portfolio as at 31 July 2023. This equity allocation therefore accounts for approximately 1.8% of portfolio. This is not considered to be significant by the Trustees and the Partners Fund (Guernsey) has not been included in the following analysis.

The Trustees' Policy Relating to the Exercise of Rights

Summary of the Policy

The Trustees' policy in relation to the exercise of rights (including voting rights) attaching to the investments is set out in the SIP, and a summary is as follows:

Has the Policy Been Followed During the Scheme Year?

The Trustees' opinion is that their policy relating to the exercise of rights (including voting rights) attaching to the investments has been followed during the Scheme Year. In reaching this conclusion, the following points were taken into consideration:

*Note the voting analysis was over the year ending 30 June 2023 because this was the most recent data available at the time of preparing this statement. The Trustees are satisfied that the analysis provides a fair representation of the investment manager's voting approach over the Scheme Year.

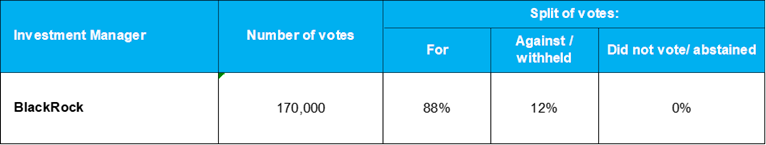

The Investment Manager's Voting Record

A summary of the investment manager's voting record is shown in the table below.

Notes

These voting statistics are based on the manager’s full voting record over the 12 months to 30 June 2023 rather than votes related solely to the funds held by the Scheme.

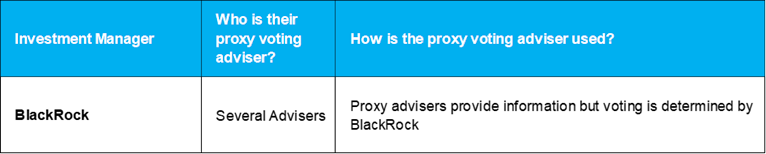

Use of Proxy Voting Advisers

The Investment Manager's Voting Behaviour

The Trustees have reviewed the voting behaviour of the investment manager by considering the following:

The Trustees have also compared the voting behaviour of the investment manager with its peers over the same period.

Further details of the approach adopted by the Trustees for assessing voting behaviour are provided in the Appendix.

The Trustees' key observations are set out below.

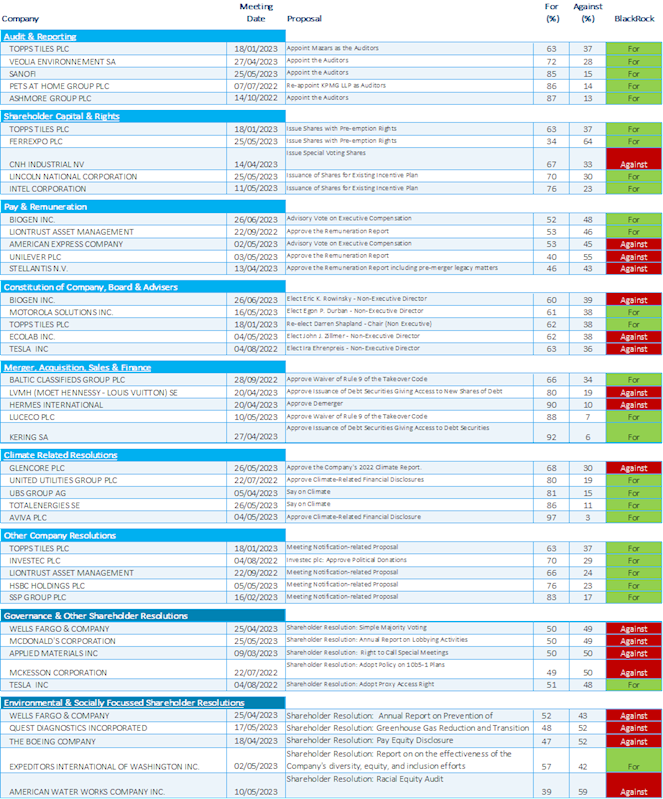

Voting in Significant Votes

Based on information provided by the Trustees' Investment Adviser, the Trustees have identified significant votes in nine separate categories. The Trustees consider votes to be more significant if they are closely contested. i.e. close to a 50:50 split for and against. A closely contested vote indicates that shareholders considered the matter to be significant enough that it should not be simply “waved through”. In addition, in such a situation, the vote of an individual investment manager is likely to be more important in the context of the overall result.

The five most significant votes in each of the nine categories based on shares held by the Scheme’s investment manager are listed in the Appendix. In addition, the Trustees considered the investment manager’s overall voting record in significant votes (i.e. votes across all stocks not just the stocks held within the funds used by the Scheme).

Analysis of Voting Behaviour

BlackRock

BlackRock appear to have reverted somewhat to a stance of being more supportive of directors and less supportive of shareholders tackling ESG issues than many of their peers.

In BlackRock’s defence, it is likely that the success of voting choice has left BlackRock with a divergent client bank. Those that wanted to take a stronger stance on ESG issues are likely to have taken up the option to let someone else take voting decisions on their behalf. The remaining clients who BlackRock continue to represent may naturally be more supportive of directors and BlackRock’s voting approach may suit them.

Partners

The Partners Fund typically has an allocation of about 20% to listed strategies but the Trustees have excluded this fund from their analysis.

The Scheme's allocation to the Partners Fund represents about 9% of total assets meaning exposure to listed strategies via the fund equates to approximately 1.8% of total Scheme assets. The Trustees do not consider this to be significant.

Partners do operate stewardship guidelines which set out principles that they will apply in all the areas we would expect them to consider. They are not signatories to the UK Corporate Governance Code but they have been assessed as A+ by UNPRI (for Strategy & Governance).

Conclusion

Based on the analysis undertaken, the Trustees have no material concerns regarding the voting records of BlackRock. However, the Trustees will keep the voting actions of BlackRock under review, noting that BlackRock’s voting records could be improved relative to some other managers.

William Medlicott Date: 8 January 2024

Signed on behalf of the Trustees of the Jockey Club Racecourses Pension Scheme

Significant Votes

The table below records how the Scheme’s investment manager voted in the most significant votes identified by the Trustees.

Note

Where the voting record has not been provided at the fund level, we rely on periodic information provided by investment managers to identify the stocks held. This means it is possible that some of the votes listed above may relate to companies that were not held within the Scheme’s pooled funds at the date of the vote. Equally, it is possible that there are votes not included above which relate to companies that were held within the Scheme’s pooled funds at the date of the vote.

Methodology for Determining Significant Votes

The methodology used to identify significant votes for this statement uses an objective measure of significance: the extent to which a vote was contested - with the most Significant Votes being those which were most closely contested.

The Trustees believe that this is a good measure of significance because, firstly, a vote is likely to be contentious if it is finely balanced, and secondly, in voting on the Trustees behalf in a finely balanced vote, an investment manager’s action will have more bearing on the outcome.

If the analysis was to rely solely on identifying closely contested votes, there is a chance many votes would be on similar topics which would not help to assess an investment manager’s entire voting record. Therefore, the assessment incorporates a thematic approach; splitting votes into nine separate categories and then identifying the most closely contested votes in each of those categories.

A consequence of this approach is that the total number of Significant Votes is large. This is helpful for assessing an investment manager’s voting record in detail but it presents a challenge when summarising the Significant Votes in this statement. Therefore, for practical purposes, the table on the previous page only includes summary information on each of the Significant Votes.

The Trustees have not provided the following information which DWP’s guidance suggests could be included in an Implementation Statement:

The Trustees are satisfied that the approach used ensures that the analysis covers a broad range of themes and that this increases the likelihood of identifying concerns about an investment manager’s voting behaviour.

The Trustees have concluded that this approach provides a more informative assessment of an investment manager’s overall voting approach than would be achieved by analysing a smaller number of votes in greater detail.